Post Market Analysis

Select a Date for Historical Data

- 7th Aug 2024 (Monday) : Positive (Tomorrow Is RBI Monetary Policy Outcome So Market Will Be Highly Volality.)

- 6th Aug 2024 (Tuesday) : Neutral (Same as previous day market open gapup as global market suggested. After opening Intraday SMI indicator give negative money flow signal. Market tried to go down but failed at the end of the day it closes as flat.)

- 5th Aug 2024 (Monday) : Neutral (Market open gapup as global market suggested. After opening Intraday SMI indicator give negative money flow signal and market follow this whole day.)

- 2nd Aug 2024 (Friday) : Negative (Market follow EOD SMI and remain negative till closing.)

- 1st Aug 2024 (Thursday) : Positive (Market not follow EOD SMI due to gap down opening, market try to recover but as the intraday money flow was negative it was not recover.)

- 31st Jul 2024 (Wednesday) : Positive (Market follow EOD SMI and remain positive till closing.)

- 30th Jul 2024 (Tuesday) : Negative (Market not follow EOD SMI due to gap up opening. They try to make down then EOD smart money close there position at NPNL or small profit. After that market follow intraday money flow as it was positive.)

Post Market Analysis

Select a Date for Historical Data

Date:- 23rd Aug 2024, 09:27

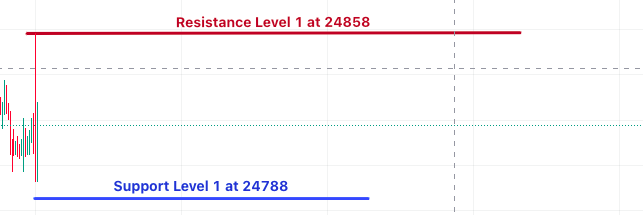

Intraday SMI Indicator is positive. If market break the resistance level 1 then there is a possibility of to go next resistance that is 24918. But EOD smart money Indicator was negative from last few days so be cautious.